June 27, 2025

As an aftermarket automotive restyler or accessories installer, staying ahead of industry trends isn’t optional—it’s essential. Fortunately, the latest SEMA Market Report 2025 and SEMA Future Trends 2025 reports deliver powerful insights to help you confidently steer your business.

Here’s what the data says—no guesswork, just facts.

Market Growth: Modest Today, Stronger Tomorrow

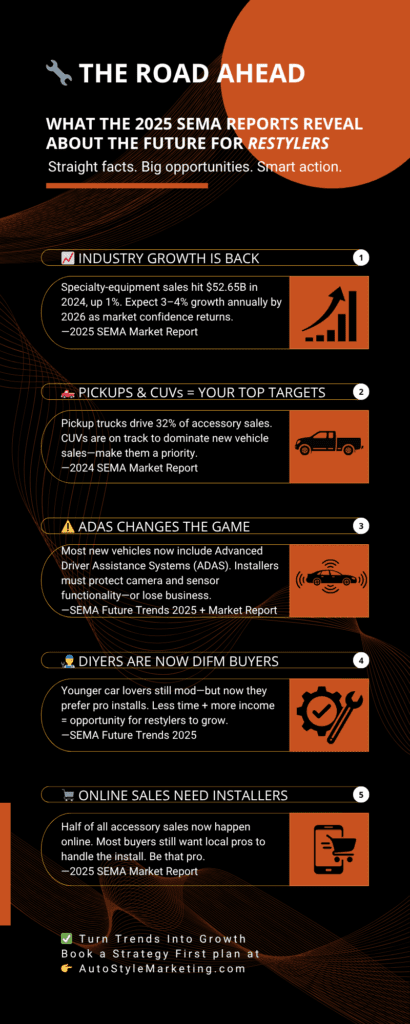

According to the 2025 SEMA Market Report, the specialty-equipment market reached $52.65 billion in 2024, marking a 1% year-over-year increase. While that’s slower than the explosive pandemic-era growth, the forecast calls for a return to a more typical 3–4% annual growth rate by 2026.

“Hopefully, as we continue to move towards a stable economy, industry sales are expected to ramp up and return to normal growth levels.”

— 2025 SEMA Market Report

Trucks and CUVs Dominate the Road—and the Market

The strongest opportunities remain in the pickup and crossover utility vehicle (CUV) segments:

- Pickups accounted for 32% of all retail specialty-equipment sales in 2023.

- CUVs are projected to make up nearly 50% of all new vehicle sales soon.

This vehicle mix has significant implications for product focus, especially for businesses offering bed accessories, towing gear, lighting, racks, and body upgrades.

EV Adoption Slowing—ICE & Hybrid Stay Relevant

Contrary to years of EV hype, the 2025 Future Trends report confirms a cooling market:

- Due to softening EV demand and policy shifts, OEMs are rebalancing toward hybrid and internal combustion engine (ICE) vehicles.

- This trend prolongs the relevance of performance and drivetrain accessories, including exhausts, air intakes, and engine dress-up parts.

ADAS Systems: A Game Changer for Installers

Modern vehicles are increasingly equipped with Advanced Driver Assistance Systems (ADAS), including sensors, cameras, and radar. These affect:

- Exterior modifications like bumpers, grilles, and lighting must not interfere with ADAS functionality.

- The opportunity: Partner with SEMA Garage or manufacturers that certify product compatibility to maintain trust and compliance.

DIY Enthusiasts Are Aging Into DIFM

Younger drivers (18–29) are still car enthusiasts, but economic pressures (higher insurance and repair costs) are leading many to:

- Delay new vehicle purchases

- Seek professional installation services instead of DIY mods

This strengthens the demand for restylers who offer white-glove install services or online-to-install funnels.

Sales Channels: Online to In-Person Matters More Than Ever

While e-commerce only represents about 15% of total U.S. retail, the specialty-equipment market is an exception. Key findings from the Market Report:

- Accessory sales are evenly split between in-store and online.

- Buyers of larger or more complex products (e.g., bumpers, electronics) prefer to order online but have them professionally installed.

This confirms the importance of positioning restyling shops as local installation partners for online shoppers.

Tariff Threats Could Disrupt the Supply Chain

Both SEMA reports highlight a key risk: potential tariffs on imported goods.

- If enacted, these could raise costs for raw materials, accessories, and parts across the board.

- Restylers may benefit by:

- Stocking or sourcing domestic products

- Emphasizing “Buy American” messaging

- Bundling installs to provide value amid rising part costs

🎯 Strategic Takeaways for Restylers

Here’s what to do with this knowledge:

| Insight | Strategic Action |

| Pickup & CUV dominance | Double down on bundled product offers for these vehicles |

| Slower EV adoption | Stay invested in ICE & hybrid-friendly performance products |

| ADAS complexity | Vet all exterior products for ADAS compatibility |

| DIY to DIFM shift | Promote pro installs, flexible financing, and “we’ll install it” offers |

| E-comm + Install | Build partnerships with online retailers or direct e-commerce |

| Tariff volatility | Offer pre-bundled packages and promote U.S.-sourced accessories |

Final Word

These reports show an industry that’s shifting, not shrinking. For aftermarket accessory installers and restylers, the opportunities are still rich, especially for those who focus on:

- The right vehicle types

- The right product categories

- The right customer behavior patterns

- And the proper strategic positioning

If you want help planning or executing a marketing strategy built around these facts, schedule a Strategy First discovery call with AutoStyle Marketing.

Sources:

- 2025 SEMA Market Report, Specialty Equipment Market Association, retrieved June 2025.

- SEMA Future Trends 2025, Specialty Equipment Market Association, retrieved June 2025.

- 2024 SEMA Market Report, Specialty Equipment Market Association.